UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

| |

| o | Preliminary Proxy Statement |

|

| |

| o | Confidential, For Use of the Commission Only |

|

| |

| x | Definitive Proxy Statement |

|

| |

| o | Definitive Additional Materials |

|

| |

| o | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

ACTUANT CORPORATION

(Exact name of registrant as specified in its charter)

Payment of Filing Fee (Check the appropriate box):

|

| |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

|

| |

| o | Fee paid previously with preliminary materials. |

|

| |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| (1) | Amount previously paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

ACTUANT CORPORATION

N86W12500 Westbrook Crossing

Menomonee Falls, Wisconsin 53051

(262) 293-1500

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders of ACTUANT CORPORATION:

Notice is hereby given that the Annual Meeting of Shareholders of Actuant Corporation, a Wisconsin corporation, which has adopted the business name “Enerpac Tool Group,” (“Enerpac Tool Group” or the “Company”) will be held on January 23, 201828, 2020 at 8:00 a.m. EasternCentral Time at the The Breakers, One South CountryWestin O’Hare, 6100 N. River Road, Palm Beach, Florida,Rosemont, Illinois, for the following purposes (all as set forth in the accompanying Proxy Statement):

1.To elect a board of nine directors;

2.To ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent auditor;

| |

| 1. | To elect eight directors from the nominees described in the accompanying proxy statement; |

| |

| 2. | To ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent auditor for the fiscal year ending August 31, 2020; |

| |

| 3. | To consider and vote upon an amendment to the Actuant Corporation 2017 Omnibus Incentive Plan; |

4.To hold an advisory (non-binding) vote to approve the compensation of our named executive officers;

| |

5. | To hold an advisory (non-binding) vote on the frequency of future advisory votes to approve the compensation of our named executive officers; |

| |

| 4. | To approve an amendment to the Company’s Restated Articles of Incorporation, as amended, to change the Company’s name to “Enerpac Tool Group Corp.” (the “Name Change Proposal”); and |

6.To transact such other business as may properly come before the Annual Meeting or any adjournment thereof.

| |

| 5. | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The Board of Directors recommends a vote FOR the election as director of each of the nominees described in the accompanying proxy statement and FOR Proposals 1, 2, 3 and 4. Further, the Board of Directors recommends future advisory votes on the compensation of our named executive officers be held annually. The Board of Directors or proxy holders will use their discretion on other matters that may arise at the 20182020 Annual Meeting.

The Board of Directors has fixed the close of business on November 17, 201722, 2019 as the record date for the determination of shareholders entitled to receive notice of and to vote at the Annual Meeting or any adjournment thereof.

Whether or not you expect to attend the Annual Meeting, please mark, sign, date and return the enclosed proxy promptly in the accompanying envelope, which requires no postage if mailed in the United States, or vote via the internet or phone (instructions on page 2). It is important that your shares be represented at the Annual Meeting, whether your holdings are large or small. If for any reason you should desire to revoke your proxy, you may do so at any time before it is voted.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on January 23, 2018.28, 2020. The proxy statement is available on Actuant Corporation’sthe Company’s website at www.actuant.com.www.enerpactoolgroup.com. You may obtain directions to the Annual Meeting by written or telephonic request directed to our Executive Vice President, General Counsel and Chief Financial Officer, Actuant Corporation,Secretary, Enerpac Tool Group, N86W12500 Westbrook Crossing, Menomonee Falls, Wisconsin 53051 or by telephone at (262) 293-1500.

By Order of the Board of Directors,

ROBERT A. PETERSONE. JAMES FERLAND

ChairmanChair of the Board

Menomonee Falls, Wisconsin

December 4, 201713, 2019

TABLE OF CONTENTS

|

| |

| | Page |

| General Information | |

| The Proposals | |

| Proposal 1: Election of Directors | |

| Proposal 2: Ratification of Selection of Independent Auditors | |

Proposal 3: Vote Upon an Amendment to the Actuant Corporation 2017 Omnibus Incentive Plan | |

Proposal 4: Advisory Vote to Approve Compensation of Our Named Executive Officers | |

Proposal 5: Advisory Vote on4: Approval of the Frequency of Future Advisory Votes to Approve Compensation ofName Change Proposal | |

Our Named Executive Officers |

| Certain Beneficial Owners | |

| Corporate Governance Matters | |

| Corporate Governance Guidelines | |

| Board Committees, Charters, Functions and Meetings | |

| Leadership Structure | 11 |

| Executive Sessions of Non-Management Directors | 11 |

Independence of Directors; Financial ExpertExpertise of Audit Committee | |

| Board Role in Risk Oversight | |

| Compensation Risk Assessment | |

| Use of Compensation Consultants and Other Advisors | |

| Codes of Conduct and Ethics | |

| Information Available Upon Request | |

| Director Selection Procedures | |

| Director Resignation Policy | |

| Communications with Directors | |

| Certain Relationships and Related Person Transactions | |

| Compensation Committee Interlocks and Insider Participation | |

| Report of the Audit Committee | |

Executive Compensation (Compensation | |

Compensation Discussion and Analysis)Analysis | |

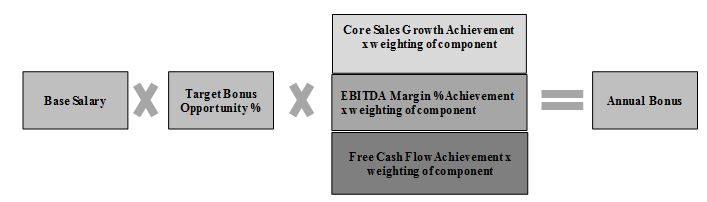

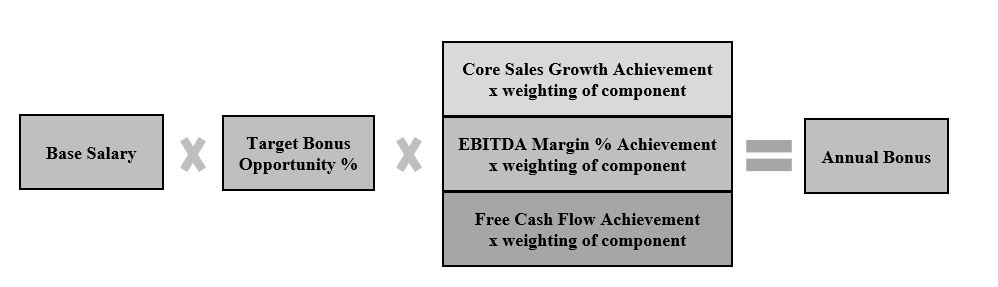

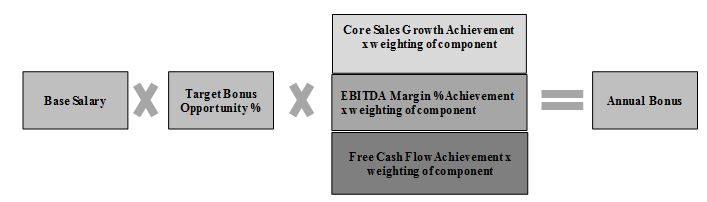

| Executive Summary | |

| Compensation and Link to Performance | |

| Shareholder Input on Executive Compensation Program | |

| Oversight of the Executive Compensation Program | |

| Assessing Competitive Compensation Practices | 18 |

| Target Level Compensation Determination | |

| Components of Executive Compensation | |

Tax Deductibility of Executive Compensation | |

| Stock Ownership Requirements | 23 |

| Anti-Hedging Policy | |

| Compensation Clawback Policy | |

| Conclusion | |

| Compensation Committee Report | |

| Summary Compensation Table | |

| Grants of Plan-Based Awards | |

| Outstanding Equity Awards at Fiscal Year-End | |

Equity Awards Exercised and Vested in Fiscal 20172019 | |

| Employee Deferred Compensation | |

| Equity Compensation Plan Information | |

| Senior Officer Severance Plan and Retention Agreement | |

Change Inin Control Payments and Other Separation Agreements | |

| CEO Pay Ratio | |

| Non-Employee Director Compensation | |

| Other Information | |

| |

EXHIBIT A: First Amendment to the Actuant Corporation 2017 Omnibus Incentive Plan | |

ACTUANT CORPORATION

N86W12500 Westbrook Crossing

Menomonee Falls, Wisconsin 53051

(262) 293-1500

PROXY STATEMENT

This Proxy Statement and accompanying proxy are being first mailed to

shareholders on or about December 4, 2017.13, 2019.

General Information

This Proxy Statement and accompanying proxy are furnished to the shareholders of Actuant Corporation (the “Company”) in connection with the solicitation of proxies by the Board of Directors of the Company for use at the Annual Meeting of Shareholders on January 23, 201828, 2020 (the “Meeting”), and at any adjournment thereof. Accompanying this Proxy Statement is a Notice of Annual Meeting of Shareholders and a form of proxy for such Meeting. The Company’s Annual Report on Form 10-K for the year ended August 31, 2017,2019, which constitutes the 20172019 Annual Report to Shareholders and accompanies this Proxy Statement, contains financial statements and certain other information concerning the Company.

Location and Date of Annual Meeting

The annual meeting will be held on January 23, 201828, 2020 at 8:00 a.m. EasternCentral Time at the The Breakers, One South CountryWestin O’Hare, 6100 N. River Road, Palm Beach, Florida.

Rosemont, Illinois.

Record Date

The record date for shareholders entitled to notice of and to vote at the Meeting is the close of business on November 17, 201722, 2019 (the “Record Date”). As of the Record Date, we had 59,955,29759,953,042 shares of Class A common stock were outstanding. Each share of Class A common stock outstanding on the record dateRecord Date is entitled to one vote on all matters submitted at the Meeting.

No other class of capital stock was outstanding on the Record Date.

Quorum

A majority of the votes entitled to be cast, represented in person or by proxy, will constitute a quorum for action at the Meeting. Abstentions will be counted as shares present for purposes of determining the presence or absence of a quorum. Proxies relating to “street name”submitted by banks, brokers or other holders of record holding shares for you as a beneficial owner that are voted by brokers ondo not indicate a vote for some matters, butor all of the proposals because that holder does not on other matters as to whichhave voting authority to vote is withheld from the broker absentand has not received voting instructions from the beneficial owner (“brokeryou (so-called “broker non-votes”) willare also considered to be treated as shares present for purposes of determining whether a quorum exists.

If you hold your shares in an account maintained by a bank, broker or other holder of record (referred to as holding shares in “street name”), these holders are permitted under the presencerules of the New York Stock Exchange to vote your shares on the ratification of the appointment of PricewaterhouseCoopers LLP as our independent auditor and on the Name Change Proposal, even if they do not receive voting instructions from you, but are not permitted under the rules of the New York Stock Exchange to vote on Proposals 1 and 3 unless you timely provide them with your voting instructions. It is important, therefore, if you hold your shares through an account maintained by a bank, broker or absenceother holder of a quorum. record that you timely provide your instructions to them so that your vote with respect to these matters may be cast.

The voting requirements and the procedures described in this section and below are based upon provisions of the Wisconsin Business Corporation Law, the Company’s articlesRestated Articles of incorporationIncorporation, as amended, and its bylaws, the rules of the New York Stock Exchange and any other requirements applicable to the matters to be voted upon.

Required Vote

Directors are elected by a plurality of the votes cast by the holders of shares entitled to vote in the election at a meeting at which a quorum is present (Proposal 1). A “plurality” means that the individuals who receive the largest number of votes are elected as directors up to the maximum number of directors to be elected at the meeting. Shares for which authority is withheld to vote for director nominees and broker non-votes have no effect on the election of directors except to the extent that the failure to vote for a director nominee results in another nominee receiving a larger number of votes.

In order to approve the ratification of PricewaterhouseCoopers LLP as our independent auditor for the fiscal year ending August 31, 2020 (Proposal 2), the votes cast FOR must exceed the votes cast AGAINST the proposal. Abstentions will have no effect on this proposal. Because this proposal is considered a routine proposal,As noted above, banks, brokers or other entities holding your shares for an owner in “street name” are ablepermitted to vote on this proposal even if noyou do not provide any voting instructions are provided by the beneficial owner. Broker non-votes will have no effect on this proposal.

In order to approve an amendment to the 2017 Omnibus Incentive Plan (Proposal 3), the votes cast FOR must exceed the votes cast AGAINST the proposal. Abstentions will have no effect on this proposal. This proposal is considered a non-routine proposal under the rules applicable to banks and brokers. As a result, if you hold your shares in "street name," absent specific voting instructions, your bank, broker or other holder of record will not be permitted to exercise voting discretion, and your shares will not be considered present and entitled to vote, with respect to this proposal. Broker non-votes will have no effect on this proposal.

instructions.

In order to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement (Proposal 4)3), the votes cast FOR must exceed the votes cast AGAINST the proposal. TheAbstentions and broker non-votes will not count in determining the outcome of the vote on this proposal.

Under our Restated Articles of Incorporation, as amended, the frequencyaffirmative vote of future advisory votestwo-thirds of the shares of Class A common stock outstanding on the Record Date is required to approve the compensation of our named executive officersName Change Proposal (Proposal 5) will be decided by a plurality of4). Accordingly, abstentions and shares not voted on the votes validly cast. AbstentionsName Change Proposal will have nothe effect on these proposals. These advisory votes are considered non–routine proposals underof a vote AGAINST the rules applicable toName Change Proposal. As noted above, banks, and brokers. As a result, if you holdbrokers or other entities holding your shares in “street name,” absent specificname” are permitted to vote on the Name Change Proposal, even if you do not provide any voting instructions, your bank,instructions.

Any other business that may properly come before the Meeting, or any adjournment of the Meeting, will be approved if more votes are cast FOR the proposal than are cast AGAINST the proposal. Accordingly, broker or other holder of recordnon-votes, if any, and abstentions will not be permittedcounted in determining the outcome of the votes on any such proposal. We are not aware of any other business to exercise voting discretion, and your shares will not be considered present and entitled to vote, with respect to these advisory votes. Broker non-votes will have no effect on these proposals.

addressed at the Meeting; however, other business may be addressed if it properly comes before the Meeting.

Cost of Soliciting Proxies

The cost of soliciting proxies, including the expense of forwarding to beneficial owners of stock held in the name of another, will be borne by the Company. In addition, officers and employees of the Company may solicit the return of proxies from certain shareholders by telephone or meeting. Such officers and employees will receive no compensation therefore in addition to their regular compensation. compensation for such solicitation. EQ Proxy is assisting us in the solicitation of proxies and provides us with advice and support related to solicitation. We do not expect the total costs to us for EQ Proxy's services to exceed $7,000.

Shares held for the accounts of participants in the Actuant CorporationCompany’s 401(k) Plan (the “401(k) Plan”) will be voted in accordance with the instructions of the participants or otherwise in accordance with the terms of such plan. Shares held for the accounts of the participants in the Actuant CorporationCompany’s Deferred Compensation Plan (the “Employee Deferred Compensation Plan”) will be voted by the rabbi trust associated with the Employee Deferred Compensation Plan, as directed by the Company.

Voting Procedures

Via the Internet—ShareholdersInternet. If you hold your shares directly—that is, not in an account maintained by a bank, broker or other entity—you can vote their shares via the Internetinternet, as instructed on the proxy card. The Internetinternet procedures are designed to authenticate a shareholder’s identity to allow shareholders to vote their shares and confirm that their instructionsvotes have been properly recorded. Internet voting for shareholders of record is available 24 hours a day and will close at 11:59 p.m. (CST) on January 22, 2018.27, 2020. The accompanying Notice instructs you how to access and review all important information in the Proxy Statement and Annual Report. You will then be directed to select a link where you will be able to vote on the proposals presented. If you hold your shares in “street name” through an account with a bank, broker or other entity, your ability to provide voting instructions via the Internet depends on the voting process of the bank, broker or other entity through which you hold the shares. Please follow their directions carefully.

By Telephone—Telephone. Shareholders who hold their shares directly may vote via telephone using the toll-free number listed on the proxy card. Voting via the telephone will close at 11:59 p.m. (CST) on January 22, 2018.

27, 2020. If you hold your shares in “street name” through an account with a bank, broker or other entity, your ability to provide voting instructions by telephone depends on the voting process of the bank, broker or other entity through which you hold the shares. Please follow their directions carefully.

By Mail—Mail. Shareholders who receive a paper proxy card may elect to vote by mail and should complete, sign and date their proxy card and mail it in the postage paid envelope provided. Proxy cards submitted by mail must be received by the time of the Annual Meeting in order for your shares to be voted.

If you hold your shares in “street name” through an account with a bank, broker or other entity, your ability to provide voting instructions by mail depends on the voting process of the bank, broker or other entity through which you hold the shares. Please follow their directions carefully.

At the Annual Meeting—Meeting. Shares held directly in your name as the shareholder of record may be voted by you in person at the Annual Meeting. Shares held beneficially in “street name” through an account with a bank, broker or other entity may be voted by you in person at the Annual Meeting only if you obtain a legal proxy from the bank, broker or other agententity that holds your shares giving you the right to vote the shares and bring such proxy to the Annual Meeting.

Revocation of Proxies

A proxy may be revoked, prior to its exercise, by executing and delivering a later dated proxy, by delivering written notice of the revocation of the proxy to the Corporate Secretary prior to the Meeting or by attending and voting at the Meeting. Attendance at the Meeting, in and of itself, will not constitute a revocation of a proxy.

Unless previously revoked, the shares represented by all properly executed proxies received in time for the Meeting will be voted in accordance with the shareholder’s directions. If no directions are specified on a duly submitted proxy, the shares will be voted, in accordance with the recommendations of the Board of Directors, FOR the election of the directors nominated by the Board of Directors, FOR the Ratificationratification of PriceWaterhouseCoopers LLP as the Company'sCompany’s independent auditor, FOR the approval of the amendment to the Actuant Corporation 2017 Omnibus Incentive Plan, FOR the approval, on a non-binding basis, of the compensation of our named executive officers, 1 YEAR frequency, on a non-binding basis,FOR approval of holding future advisory votes to approve the compensation of our named executive officersName Change Proposal and in accordance with the discretion of the persons appointed as proxies on any other matters properly brought before the Meeting.

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors currently consists of nine members. AtCurrent director Holly A. Van Deursen, who has served as a director since 2008, will be retiring from the Board of Directors at the Meeting, at which time the size of the Board of Directors will be reduced from nine to eight. Directors are elected annually for one-year terms. Accordingly, at the Meeting, eight directors will be elected to serve until the next annual meeting of shareholders and until their successors shall be elected and qualified. The Board of Directors has nominated the eight individuals listed below for election as directors at the Meeting, each of whom is presently serving as a director of the Company. It is the intention of the persons named in the accompanying form of proxy to nominate as directors and, unless otherwise specified in a proxy by a shareholder, to vote such proxy for the election of the persons named below.below, unless otherwise instructed by a shareholder in a completed proxy that is timely submitted. In the event any of the nominees should become unable to serve as a director, an eventuality which management has no reason to believe will occur, proxies may be voted for another nominee. Each person named below is presently serving as a director of the Company.

|

| | | | |

| Directors standing for re-election | | Age | | Director Since |

| Randal W. Baker, Chief Executive Officer | | 54 | | 2016 |

| Gurminder S. Bedi, Director | | 70 | | 2008 |

| Danny L. Cunningham, Director | | 62 | | 2016 |

| E. James Ferland, Director | | 50 | | 2014 |

| Richard D. Holder, Director | | 54 | | 2017 |

| R. Alan Hunter, Jr., Director | | 70 | | 2007 |

| Robert A. Peterson, Chairman of the Board, Director | | 61 | | 2003 |

| Holly A. Van Deursen, Director | | 58 | | 2008 |

| Dennis K. Williams, Director | | 71 | | 2006 |

|

| | | | |

| Directors standing for re-election | | Age | | Director Since |

| Alfredo Altavilla, Director | | 56 | | 2018 |

| Judy L. Altmaier | | 58 | | 2019 |

| Randal W. Baker, President and Chief Executive Officer | | 56 | | 2016 |

| J. Palmer Clarkson, Director | | 62 | | 2018 |

| Danny L. Cunningham, Director | | 64 | | 2016 |

| E. James Ferland, Non-Executive Chairman of the Board | | 53 | | 2014 |

| Richard D. Holder, Director | | 56 | | 2017 |

| Sidney S. Simmons, Director | | 61 | | 2018 |

Alfredo Altavilla—Mr. Altavilla retired from a 29-year career at Fiat Chrysler in August 2018, mostly recently having served as Chief Operating Officer, Europe, Africa and Middle East and Head, Business Development, Fiat Chrysler Automobiles. Prior to that role, he served as Chief Executive Officer of Iveco, Fiat Chrysler’s trucks and commercial vehicles business. Mr. Altavilla brings extensive operating, business development, new product development and acquisition experience to the Board. His expertise in doing business in Europe and the Middle East also provides insights critical to the Board’s oversight of Company operations and growth strategies in those markets. Mr. Altavilla currently is on the boards of Recordati SpA, where he serves as Vice-Chairman, and Tim SpA, both of which are listed on the Milan stock exchange. He also is a Senior Advisor to CVC Capital Partners.

Judy L. Altmaier—Ms. Judy L. Altmaier served as the President of Exmark Manufacturing Co., a subsidiary of The Toro Company, from 2013 until her retirement in January 2019. Prior to that, she was Vice President, Operations and Quality Management of The Toro Company, or Toro, from 2009 until 2013. Before joining Toro, she spent more than 25 years with Eaton, holding positions of increasing responsibility including Vice President of Operations, Auto Group Americas during 2009 and Vice President, General Manager Global Engine Valve Division in Turin, Italy from 2007 until 2009. Ms. Altmaier joined Eaton in 1983 as an accountant. Ms. Altmaier has joined the Company’s Board because of her industry experience in manufacturing, operations, supply chain management, mergers and acquisitions and product development and strategy, including in the areas of automation and electrification, developed over her career with The Toro Company and Eaton. In addition, she brings significant experience in international operations and execution of growth initiatives. Ms. Altmaier serves on the Board of Allison Transmission Holdings, Inc. and is a member of its Finance and Compensation committees.

Randal W. Baker—Mr. Baker was appointed President and Chief Executive Officer of the Company in March 2016. Prior to joining the Company, Mr. Baker held multiple roles during a six yearhis six-year tenure at Joy Global, including most recently as Chief Operating Officer. Prior to Joy Global, Mr. Baker was an executive with Case New Holland Inc., holding a variety of roles including President and CEO of its agricultural equipment business. Mr. Baker also held diverse leadership roles in marketing, sales, product development and engineering at Komatsu America Corporation, Ingersoll-Rand and Sandvik Corporation.

Gurminder S. Bedi—Mr. Bedi serves on Among other insights, his understanding of the board of directors of Kemet Corporation and Blue Bird Corporation and is a retired Vice President of Ford Motor Company. He previously served on the board of directors of Compuware Corporation. Mr. Bedi served in a variety of managerial positions at Ford Motor Company for more than thirty years and holds degrees in mechanicalCompany’s markets, engineering and new product development background and operational expertise assist the Board in setting the Company’s strategy and monitoring performance.

J. Palmer Clarkson—Mr. Clarkson is President and Chief Executive Officer of Bridgestone HosePower LLC, a Florida-based industrial hose service company. Founded by Mr. Clarkson in 1990 and acquired by Bridgestone Hose in 2014, HosePower is the largest U.S. based service provider of hydraulic and industrial hoses used in construction machinery, mining, oil field equipment and general industrial applications. His areas of expertise include financial and operational management, distribution and dealer channel management, business administration.development and capital allocation. Mr. Bedi’s broad experience in manufacturing operationsClarkson brings a significant understanding of the Company’s tools business and international business,sales channels to the Board as well as his automotivestrong financial and commercial truck market background are key contributions to the Board.accounting experience. Mr. BediClarkson has been a director of CNX Resources Corporation since May 2017. He was also brings to the Board a familiarity with the challenges facing large, international public companies, as well as private equity groups (which are the sourcedirector of some of the Company’s business acquisitions).

CONSOL Energy Inc. from May 2017 through November 2018.

Danny L. Cunningham—Mr. Cunningham is a retired Partner and former Chief Risk Officer of Deloitte & Touche, LLP, a multinational public accounting firm. He has more than 30 years of experience serving public audit clients in a broad array of industries, including manufacturing. He has practiced in both the United States and China. Mr. Cunningham bringspossesses expertise in the

areas of financial reporting, auditing, accounting and auditing matters,risk management and also brings a strong knowledge of corporate transactions and a global perspective to the Board.

He also serves on the Board of WEC Energy Group and is a member of its Audit Committee.

E. James Ferland—Mr. Ferland is the retired Chairman and Chief Executive Officer of Babcock & Wilcox Enterprises, Inc. (“B&W”), a provider of energy and environmental products and services for power and industrial markets worldwide. Mr. Ferland hasHe held this position sincethose positions from July 2015, when B&W was spun-off from Thethe Babcock & Wilcox Company.Company, until 2018. Mr. Ferland was President and Chief Executive Officer of The Babcock & Wilcox Company from 2012 through the date of the spin-off. He also served as a director during this time. Mr. Ferland also previously held various leadership roles with Westinghouse Electric Company, LLC and PNM Resources, Inc. With more than 25 years of senior management and engineering experience in diversified industries, Mr. Ferland brings to the Board extensive operations, financial and acquisition experience, knowledge of the energy markets and valuable perspectives from leading a global public company. Mr. Ferland is also a director at B&W.

Richard D. Holder—Mr. Holder —Mr. Holder iswas most recently President and Chief Executive Officer of NN Inc, a diversified industrial manufacturing company. Mr. Holder has held this position since joining NN incompany, from June 2013. Mr. Holder2013 to September 2019. He is a seasoned executive with more than 25 years of international experience across a diverse set of industries and disciplines. Prior to NN, Inc., Mr. Holder held a variety of leadership positions during his twelve yeartwelve-year tenure at Eaton Corporation, where he last served as President of Eaton Electrical Components Group, a unit of Eaton’s Electrical Sector. Prior to joining Eaton, he held a variety of leadership roles at US Airways, AlliedSignal and Parker Hannifin. As a sitting Chief Executive Officer, Mr. Holder brings to the Board a unique perspectiveperspectives from recently leading a global public company, along with extensive business, financial and industry experience. Mr. Holder is alsowas a director forof NN, Inc. from 2013 through 2019.

R. Alan Hunter, Jr.—Sidney S. Simmons—Mr. HunterSimmons is a retired executive from Stanley Black & Decker whereseasoned corporate attorney with over 35 years of experience. He provides legal counseling to a range of corporate clients, assisting them, among other matters, with mergers and acquisitions, business planning and structuring, and negotiating and implementing complex business transactions. In addition to his deep and broad knowledge and his experience in executing commercial transactions, he last served as Presidentbrings experience in corporate governance and Chief Operating Officer from 1993 through 1997,legal and regulatory compliance to the Board’s deliberations as well as Vice President Financeexperience in recruiting and Chief Financial Officer from 1986 to 1993. With over twenty yearsretaining executive talent. He has a long history of experience at The Stanley Works, Mr. Hunter bringsvolunteer service with various national and local organizations, some of which include serving as a strong financial backgroundtrustee for Catholic Charities USA and thorough knowledge of the industrial tool industry to the Board. The Board also benefits from his considerable international business experience, especially related to finance, operations, business development and strategy. Mr. Hunter currently serves on the board of trustees of four mutual fund groups managed by MassMutual Financial Group.

Robert A. Peterson—Mr. Peterson held the position ofas Chairman of the Board of Barrier Safe Solutions International, Inc, formerly a private equity owned business, from 2011 until it was sold to Ansell LimitedDirectors of St. Vincent’s Health System, Inc., in 2014. Mr. Peterson was President and Chief Executive Officer of Norcross Safety Products, a private equity owned business, since its inception in 1995 until it was sold to Honeywell in 2008. Prior to that he held executive level leadership positions with a number of firms including Farley Industries and Wright Line, after beginning his career at Ernst & Young. Mr. Peterson’s extensive finance, mergers and acquisition and private equity background has been beneficial to the Board in evaluating financial performance and strategic acquisitions. Additionally, his manufacturing and distribution industry experience is a good fit for the businesses included in the Company’s Industrial segment.

Holly A. Van Deursen—Ms. Van Deursen was most recently an executive in the petrochemical industry, having held a variety of leadership positions at both British Petroleum and Amoco Corporation. She was Group Vice President of Petrochemicals for British Petroleum from 2003 to 2005 and Group Vice President of Strategy from 2001 to 2003. Ms. Van Deursen has extensive experience in the oil & gas industry, which provides the Board with insight on our businesses in the Energy segment. Her experience in strategic analysis and corporate governance further enhances her ability to add value to our Board. She is currently a director of Bemis Company, Inc., Petroleum Geo-Services and Capstone Turbine Corporation.

Dennis K. Williams—Mr. Williams is a retired President and Chief Executive Officer (2000 to 2005) and Chairman of the Board (2000 to 2006) of IDEX Corporation. Prior to that he held several executive level roles at General Electric. Mr. Williams brings to the Board considerable experience and insight into issues facing large international public companies, knowledge specific to our markets (with over thirty years experience in our industries) and a strong track record of growing businesses. Mr. Williams’ background as an executive of a global company also lends a valuable perspective to the Board on executive compensation, financial matters and business innovation. Mr. Williams is currently a director of Owens-Illinois, Inc. and Ametek, Inc.

Jacksonville, Florida.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEVOTING “FOR” THE ELECTION OF THE NINEEIGHT NOMINEES.

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

PricewaterhouseCoopers LLP, an independent registered public accounting firm, performed an audit of our consolidated financial statements for the fiscal year ended August 31, 20172019 and the effectiveness of our internal control over financial reporting as of August 31, 2017.2019. The Audit Committee of the Board of Directors has selected PricewaterhouseCoopers LLP to serve as our independent registered public accounting firm for the fiscal 2018year ending August 31, 2020 and the Audit Committee is presenting this selection to shareholders for ratification.

Shareholder ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent auditor is not required by the Company'sCompany’s bylaws, however, the Audit Committee is submitting the selection of PricewaterhouseCoopers LLP for shareholder ratification because the Audit Committee values shareholders’ views on the Company’s independent auditors. If the shareholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain PricewaterhouseCoopers LLP. The Audit Committee also retains the right to direct the appointment of a different independent accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its shareholders.

A representative of PricewaterhouseCoopers LLP will be present at the Annual Meeting and will have the opportunity to make a statement and respond to appropriate questions.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTEVOTING “FOR” RATIFICATION OF THE SELECTION OF PRICEWATERHOUSECOOPERS LLP AS OUR INDEPENDENT AUDITORS.

PROPOSAL 3

VOTE UPON AN AMENDMENT TO THE ACTUANT CORPORATION 2017 OMNIBUS INCENTIVE PLAN

Introduction

On October 17, 2017, our Board of Directors approved, subject to shareholder approval, the First Amendment to the Actuant Corporation 2017 Omnibus Incentive Plan (the “Omnibus Plan”), which amends the permitted terms for Performance-Based Awards under Section 11 of the Omnibus Plan and provides that cash-based incentive awards may be granted as Performance-Based Awards under the Omnibus Plan. A “Performance-Based Award” is an equity-based or cash-based award granted in a manner such that it qualifies for the performance-based compensation exemption from Section 162(m) of the Code.

Previously, the Compensation Committee has awarded cash incentive compensation under the Actuant Corporation Executive Officer Bonus Plan. We are seeking shareholder approval so that both equity-based and cash-based awards be granted under the Omnibus Plan as Performance-Based Awards, which will simplify and unify our plan administrative practices.

If the Amendment is approved by our shareholders, all equity-based and cash-based awards that are intended to qualify as “performance-based compensation” will be granted as Performance-Based Awards under the Omnibus Plan after the 2018 Annual Meeting. In addition, no further awards would be made under the Actuant Corporation Executive Officer Bonus Plan.

If the Amendment is not approved, we will be unable to grant future cash-based incentive awards under the Omnibus Plan or Executive Officer Bonus Plan as “performance-based compensation” exempt from the $1 million deduction limitation under Section 162(m).

Material Terms for Performance Goals under Performance-Based Awards

As defined in the tax rules, stockholders must approve each of the material terms of performance goals if the Company is to obtain tax deductions for the specified forms of performance-based compensation for executives whose total annual compensation exceeds $1 million, including (i) the employees eligible to receive compensation, (ii) the description of the business performance criteria on which the performance goals are based and (iii) the maximum amount of performance-based compensation that can be paid to an employee. Each of these aspects is discussed below.

The following is a summary of the material features of the Amendment. The following summary is qualified in its entirety by reference to the terms of the Amendment, which is attached to this proxy statement as Exhibit A.

Group of Employees Covered

Only executive officers shall be eligible to receive cash-based incentive compensation in the form of Performance-Based Awards.

Performance Criteria

The Amendment sets forth a unified set of performance criteria when granting either cash-based or equity-based incentive compensation as Performance-Based Awards under the Omnibus Plan. Performance criteria that can be used for Performance-Based Awards (collectively “Performance Objectives”) may be absolute in their terms or measured against or in relationship to other companies or other external or internal measures. Performance Objectives may be designated to include or exclude the impact of extraordinary charges, losses from discontinued operations, restatements and accounting changes and other special charges such as restructuring expenses, currency fluctuations, acquisitions and divestitures and related expenses (including without limitation expenses related to goodwill and other intangible assets), exchange rate effects, the effect of changes in tax laws, corporate tax rates, accounting principles or other applicable laws, foreign exchange gains and losses, stock offerings, stock repurchases, strategic loan loss provisions, a change in the Company's fiscal year, litigation or claim judgments or settlements, and other unusual, transition, one-time and/or non-recurring items of gain or loss that are separately identified and quantified in the Company’s audited financial statements. However, notwithstanding the preceding sentence, unless the Compensation Committee determines otherwise prior to the end of the applicable time for establishing Performance Objectives for an Award under Section 162(m), to the extent any such item affects any Performance Objective applicable to a Performance-Based Award, such item shall be automatically excluded or included in determining the extent to which a performance goal has been achieved, whichever will produce the higher payout under an Award (subject to any exercise of “negative discretion” by the Compensation Committee solely with respect to cash-based incentive compensation).

Performance Objectives with respect to a Performance-Based Award may include any one or more of the following objectives or combination thereof (or an equivalent metric), as established by the Compensation Committee in its sole discretion: (i) achieving a target level of Company net sales; (ii) achieving a target level of earnings (including net earnings; gross earnings; earnings before

certain deductions, such as interest, net financing costs, taxes, depreciation, or amortization; or earnings per share or diluted earnings per share); (iii) achieving a target level of income (including net income or income before consideration of certain factors, such as overhead) or a target level of profit margin or profits (operational, net or gross profits for the Company, an Affiliate, or a business unit) ; (iv) achieving a target return on the Company’s (or an Affiliate’s) sales, revenues, capital, assets, or shareholders’ equity; (v) revenue growth (whether including or excluding the impact of foreign currency translation changes), (vi) maintaining or achieving a target level of appreciation in the price of the shares of Common Stock; (vii) achieving a target market share for the Company (or an Affiliate); (viii) achieving or maintaining a share price that meets or exceeds the performance of specified stock market indices or other benchmarks over a specified period; (ix) achieving a level of share price, earnings, or income performance that meets or exceeds performance in comparable areas of peer companies over a specified period; (x) achieving specified reductions in costs or targeted levels in costs; (xi) achieving specified improvements in collection of outstanding accounts or specified reductions in non-performing debts; (xii) achieving a level of cash flow or working capital; (xiii) introducing one or more products into one or more new markets; (xiv) acquiring a prescribed number of new customers in a line of business; (xv) achieving a prescribed level of productivity within a business unit; (xvi) completing specified projects within or below the applicable budget; (xvii) completing acquisitions of other businesses or integrating acquired businesses; (xviii) expanding into other markets; (xix) asset carrying charge, as defined in the Bonus Plan or otherwise; (xxi) free cash flow and (xxii) net assets employed, as defined in the Bonus Plan or otherwise. Any criteria used may be measured, as applicable, (A) in absolute terms, (B) in relative terms (including without limitation by the passage of time, comparison of the Company’s performance as to one or more of the objectives listed above against another listed objective (such as EBITDA as a percentage of sales) and/or against another company or companies), (C) on a per-share basis, (D) against the performance of the Company as a whole or a segment of the Company, (E) on a pre-tax or after-tax basis, and/or (F) on a GAAP or non-GAAP basis.

Cash Incentive Awards

The Amendment also allows for Cash Incentive Awards to be granted under the Omnibus Plan. A “Cash Incentive Award” is a cash bonus opportunity awarded by the Compensation Committee pursuant to which an executive officer may become entitled to receive an amount of cash denominated in U.S. dollars or another currency based on satisfying one or more performance goals and vesting requirements as are specified in the Award Agreement or, if no Award Agreement is entered into with respect to the Cash Incentive Award, other documents evidencing the Award. A Cash Incentive Award may, but need not, be granted as a Performance-Based Award under Section 11 of the Plan. Cash Incentive Awards may be granted alone or in tandem with other awards granted under the Omnibus Plan. Cash Incentive Awards may be granted only to executive officers.

Per-Person Maximum Limits

An executive officer may receive no more than $2,500,0000 with respect to a Cash Incentive Award during a calendar year. All other limits under the Omnibus Plan for other forms of Performance-Based Awards will remain the same under the Amendment. In any calendar year, an eligible employee or director may receive, under the Omnibus Plan, stock options or stock appreciation rights with respect to no more than 1,000,000 shares of our common stock. In addition, in any calendar year, an eligible employee or director may receive restricted stock, restricted stock units, unrestricted grants of shares or other similar awards (whether performance-based or time-vested) with respect to no more than 500,000 shares of our common stock. Notwithstanding the foregoing, for an eligible outside director, the aggregate grant date fair value of awards granted to such an individual under the Omnibus Plan, as amended, during any calendar year, along with any regular cash retainer or meeting fees paid to such individual during the calendar year, shall not exceed $700,000. In the event an individual employee becomes an outside director (or vice versa) during a calendar year, the limit set forth in the immediately preceding sentence shall not apply to awards granted to such an individual in the individual’s capacity as an employee.

Summary of Other Plan Provisions

The following is a summary of the other material terms of the Omnibus Plan, which was approved by stockholders at the 2017 Annual Meeting. A copy of the Omnibus Plan can be accessed at: https://www.sec.gov/Archives/edgar/data/6955/000000695516000087/atuproxyfy2016.htm.

Types of Awards

Awards under the Plan may consist of any combination of stock options, stock appreciation rights, restricted stock, restricted stock units, other stock-based awards and cash incentive awards. As used in this section, the phrase “other stock-based awards” means all awards other than stock options, stock appreciation rights, restricted stock and restricted stock units.

Share Reserve

Our shareholders approved 4,325,000 shares of our common stock for awards under the Omnibus Plan at the Company’s 2017 Annual Meeting. This amount was in addition to the number of shares of our common stock subject to awards outstanding under our

preexisting stock plans that become available for future grant under the Omnibus Plan because they are forfeited or cancelled. The number of shares that remained available for grant under the Plan and all other equity compensation plans we sponsor as of the end of our last fiscal year are set forth below following this Proposal under the heading “Equity Compensation Plan Information.”

Administration

The Omnibus Plan will be administered by the Compensation Committee of our Board of Directors. The Omnibus Plan gives the Compensation Committee discretion to make awards under the Omnibus Plan, to determine the type, size and the terms of awards, to determine the criteria for vesting and exercisability, to establish rules for the administration of the Omnibus Plan, and to make any other determinations that it deems necessary or desirable for the administration of the Omnibus Plan.

Eligibility

The persons who are eligible to participate in the Omnibus Plan include directors and employees (including officers) of the Company and its subsidiaries. Approximately 400 employees and 8 non-management directors are eligible to participate in the Plan. However, only non-employee directors and employees selected by the Compensation Committee will be granted awards under the Plan. The number of eligible employees is expected to increase over time based upon the future growth and needs of the Company.

Stock Options

Stock options granted under the Omnibus Plan may be either incentive stock options, which are intended to satisfy the requirements of Section 422 of the Internal Revenue Code, or non-qualified stock options, which are not intended to meet those requirements. The exercise price of a stock option may not be less than 100% of the fair market value of our common stock on the date of grant and the term may not be longer than 10 years, subject to certain rules applicable to incentive stock options; provided, that if a stock option other than an incentive stock option has an expiration date within 3 days of a Company “black-out period,” the expiration date of such stock option shall be extended for a period of 30 days following the end of the “black-out period” or such longer period as permitted by the Compensation Committee. The Omnibus Plan prohibits the repricing of outstanding stock options. Grantees will not be entitled to receive any dividends or other distributions paid with respect to a stock option. Award agreements for stock options may include rules for the effect of a termination of service on the option and the term for exercising stock options after any termination of service. No option may be exercised after the end of the term set forth in the award agreement.

Stock Appreciation Rights

A stock appreciation right entitles the grantee to receive, with respect to a specified number of shares of common stock, any increase in the value of the shares from the date the award is granted to the date the right is exercised. The base price of a stock appreciation right may not be less than 100% of the fair market value of our common stock on the date of grant and the term may not be longer than 10 years. Except as otherwise provided by the Compensation Committee, stock appreciation rights will only be settled in shares of our common stock. Grantees will not be entitled to receive any dividends or other distributions paid with respect to a stock appreciation right. Award agreements for stock appreciation rights may include rules for the effect of a termination of service on the stock appreciation right and the term for exercising stock appreciation rights after any termination of service. No stock appreciation right may be exercised after the end of the term set forth in the award agreement.

Restricted Stock

Restricted stock is common stock that is subject to restrictions, including a prohibition against transfer and a substantial risk of forfeiture, until the end of a “restricted period” during which the grantee must satisfy certain vesting conditions (which may include attaining certain performance goals). Unless otherwise determined by the Compensation Committee, if the grantee does not satisfy the vesting conditions by the end of the restricted period, the restricted stock will be forfeited. Restricted stock awards in excess of 5% of the number of shares available for awards under the Omnibus Plan that are conditioned on a participant’s continued employment with the Company or one of its affiliates will not become vested earlier than one year from the date of grant. During the restricted period, the holder of restricted stock has the right to vote the shares of restricted stock but will not have the right to receive dividends with respect to such shares, unless, in each case, otherwise provided for by the Compensation Committee.

Restricted Stock Units

A restricted stock unit entitles the grantee to receive common stock after a “restricted period” during which the grantee must satisfy certain vesting conditions (which may include attaining certain performance goals). Unless otherwise determined by the Compensation Committee, if the grantee does not satisfy the vesting conditions by the end of the restricted period, the restricted stock unit will be forfeited. The Compensation Committee is authorized (but not required) to grant holders of restricted stock units the right to receive dividend equivalents on the underlying common stock. Awards of restricted stock units in excess of 5% of the number of

shares available for awards under the Omnibus Plan that are conditioned on a participant’s continued employment with the Company or one of its affiliates will not become vested earlier than one year from the date of grant.

Other Equity-Based Awards

The Omnibus Plan also authorizes the Compensation Committee to grant other types of equity-based compensation, including deferred stock units, unrestricted shares, and other awards that are convertible into our common stock. For example, the Compensation Committee may grant awards that are based on the achievement of performance goals. Other such awards in excess of 5% of the number of shares available for awards under the Omnibus Plan that are conditioned upon a participant's continued employment with the Company or one of its affiliates will not become vested earlier than one year from the date of grant.

Amendment and Termination

Our Board may amend or terminate the Omnibus Plan at any time. No amendment that increases the total number of shares of common stock that may be granted under the Omnibus Plan, increases the maximum number of shares of common stock that may be issued to any individual participant, or amends the Omnibus Plan provision that prohibits repricing of options or stock appreciation rights without shareholder approval will be effective unless it is approved by our shareholders. Without the consent of an affected participant, no action may adversely affect in a material manner any right of such participant under any previously granted award.

Tax Information

Equity-based and cash-based awards granted under the Omnibus Plan may be, but are not required to be, structured to qualify as performance-based compensation under Section 162(m) of the Code. Awards must satisfy the conditions set forth in Section 162(m) of the Code to qualify as “performance-based compensation”, and stock options and other awards must be granted under the Omnibus Plan by a committee consisting solely of two or more “outside directors” (as defined under Section 162(m) regulations) and must satisfy the Omnibus Plan’s limit on the total number of shares that may be awarded to any one participant during a year. For awards other than stock options and stock appreciation rights to qualify, the grant, issuance, vesting, or retention of the award must be contingent upon satisfying one or more of the performance criteria set forth in the Omnibus Plan, as established and certified by a committee consisting solely of two or more “outside directors.” The rules and regulations promulgated under Section 162(m) are complicated and subject to change from time to time, and may apply with retroactive effect. In addition, a number of requirements must be met in order for particular compensation to so qualify. As such, there can be no assurance that any compensation awarded or paid under the Plan will be deductible under all circumstances.

New Plan Benefits

Because of the discretionary nature of any future awards to executive officers under the Plan, the amount of awards to be made after the 2018 Annual Meeting is not determinable at this time.

Reasons for Approval

The Board of Directors believes that the approval of the Amendment will benefit the Company by simplifying plan administration and allowing our Compensation Committee to grant compensation in ways that will preserve tax deductions for the Company on certain types of equity-based and cash-based incentive compensation.

Vote Required for Approval

A quorum being present, the affirmative vote of a majority of the votes cast is necessary to approve the material terms of the performance goals and provision for cash awards under the Omnibus Plan.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" APPROVAL OF THE AMENDMENT TO THE ACTUANT CORPORATION 2017 OMNIBUS INCENTIVE PLAN.

PROPOSAL 4

ADVISORY VOTE TO APPROVE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

We are asking our shareholders to approve, on a non-binding advisory basis, the compensation of our Namedthe executive officers named in the Summary Compensation Table included in this proxy statement (the “Named Executive Officers ("NEOs"Officers” or “NEOs”), as disclosed in the Compensation Discussion and Analysis section and the accompanying compensation tables and narrative discussion contained in this proxy statement. The Compensation Committee has overseen the development and implementation of our executive compensation programprograms, which isare designed to drive long-term success and increase shareholder value. We utilize our executive compensation programprograms to provide competitive compensation within our industry peer group that will attract and retain executive talent, encourage our leaders to perform at a high level by linking compensation with financial and performance milestones and align our executive compensation with shareholders’ interests through the use of equity-based incentive awards.

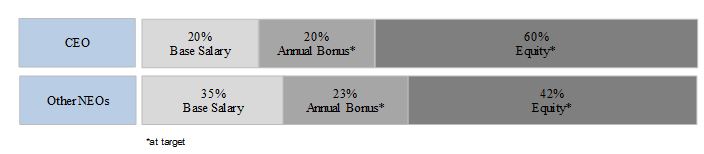

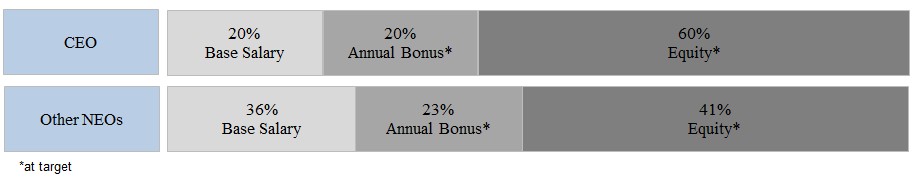

Our overall executive compensation program is founded on three guiding principles, which we believe emphasizesemphasize a pay for performancepay-for-performance philosophy:

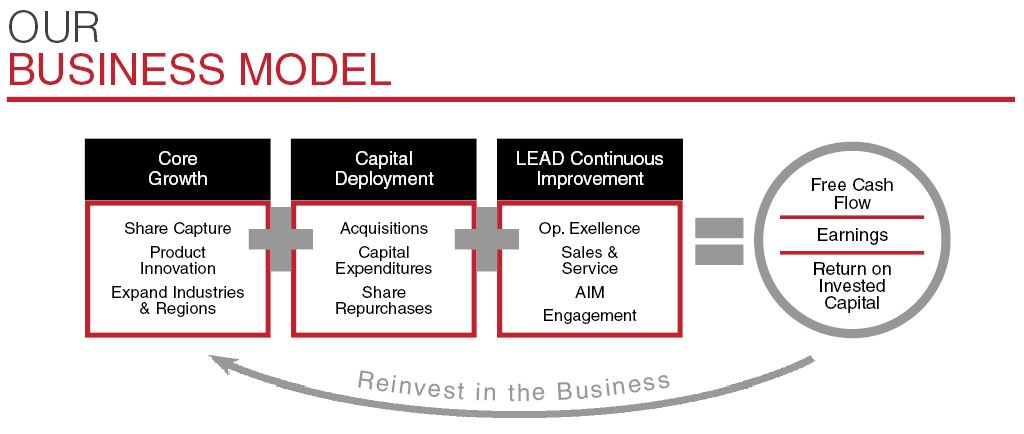

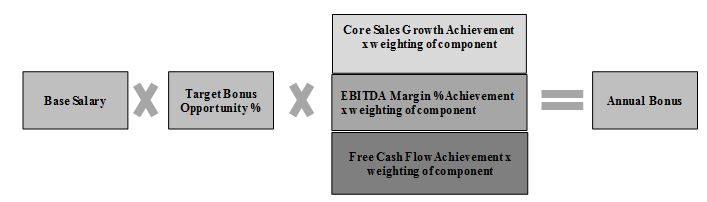

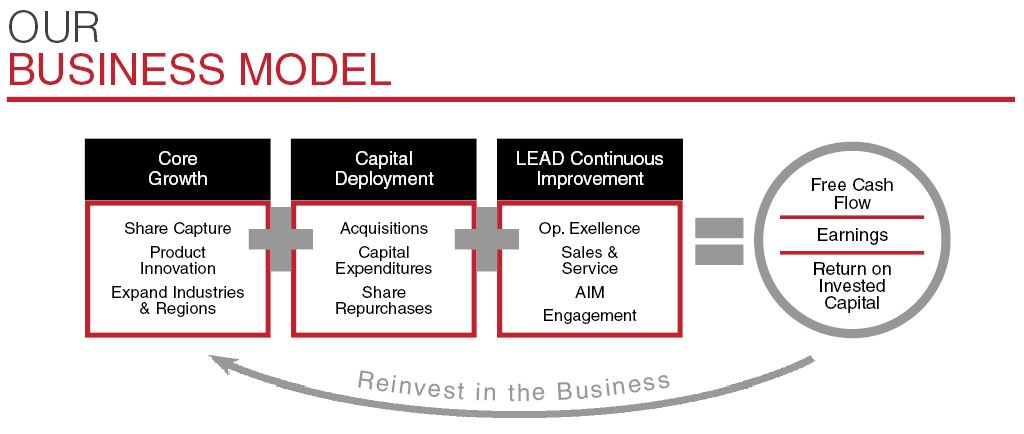

Executive compensation is aligned with our overall business strategy of driving growth opportunities and improving operating metrics, focusing on sales, earnings, cash flow and return on invested capital.

Key executives responsible for establishing and executing our business strategy should have incentive compensation opportunities that align with long-term shareholder value creation. Performance equity awards, a compensation clawback policy, stock ownership requirements and multi-year vesting periods on equity awards are important components of that alignment.

| |

| • | Our overall compensation targets reflect our intent to pay executive Total Direct Compensation (base salary, annual bonus opportunity and the value of share based awards) at approximately the 50th percentile of pay. In some cases, to attract and retain top talent, we may set target compensation over market rates (generally not to exceed the 75th percentile) to align with an individual’s experience profile and reflect the complexities of certain roles. |

We believe that our pay-for-performance objectives result in compensation that reflects our financial results, stock price performance and other performance objectives described in the Compensation Discussion and Analysis. Accordingly, the Board of Directors requests our shareholders to approve, on an advisory basis, the compensation of our NEOs. Although the outcome of this advisory vote is non-binding, the Compensation Committee and the Board of Directors will review and consider the outcome, among other factors, when making future compensation decisions for our NEOs.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTEVOTING “FOR” THE APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THE EXECUTIVE COMPENSATION DISCUSSION AND ANALYSIS SECTION AND THE ACCOMPANYING COMPENSATION TABLES AND NARRATIVE DISCUSSION CONTAINED IN THIS PROXY STATEMENT.

PROPOSAL 54

ADVISORY VOTE ONAPPROVAL OF THE FREQUENCY OF FUTURE ADVISORY VOTES TO APPROVE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERSNAME CHANGE PROPOSAL

As required by Section 14A of the Securities Exchange Act of 1934, we are asking our shareholders to vote, on a non-binding, advisory basis, on the frequency of future advisory votes to approve the compensation of our named executive officers. Specifically, shareholders may vote on whether the advisory vote to approve the compensation of our named executive officers should occur every one, two or three years.

The Board of Directors has given serious consideration to the recommended frequency of future advisory votes on the compensation of our named executive officers, including consideration of the results of prior shareholder voting specific to advisory votes on the frequency of approving the compensation of our named executive officers. After considering the benefits and consequences of each option for holding the advisory vote on the compensation of our named executive officers,On October 29, 2019, the Board of Directors recommendsunanimously adopted a resolution to amend, and to recommend that the shareholders approve, holdingan amendment to Article I of the advisory vote onCompany’s Restated Articles of Incorporation, as amended (the “Restated Articles of Incorporation”) for the compensationpurpose of changing the Company’s corporate name from “Actuant Corporation” to “Enerpac Tool Group Corp.” Specifically, this Name Change Proposal would amend Article I of the Restated Articles of Incorporation as set forth below, with additions indicated by underlining and deletions by strike through:

“The name of the Corporation is Actuant CorporationEnerpac Tool Group Corp.”

Reasons for Name Change

In anticipation of the completion of the sale of the principal businesses comprising our named executive officers once every year.former Engineered Components & Systems (“EC&S”) segment, in September 2019 we adopted the business name “Enerpac Tool Group” to simplify and accelerate the Company’s continued progression toward becoming a premier pure-play industrial tools and services company with the Enerpac brand at its core. Although we adopted the new business name, a change in our legal, corporate name requires that we amend the Restated Articles of Incorporation to reflect that change in name.

Effects of Name Change

An annual advisory vote onIf the compensationshareholders approve the proposed amendment to the Restated Articles of our named executive compensationIncorporation, the amendment will allowbecome effective upon the filing of articles of amendment to the Restated Articles of Incorporation with the Wisconsin Department of Financial Institutions, which would be filed at some time after the Meeting.

While the name change will cause us to obtain information on shareholders’ views of the compensation of our named executive officers on a current basis. Additionally, an annual advisory vote on the compensation of our named executive officers will provideincur certain modest costs, the Board of Directors believes that any potential confusion and costs associated with the name change will be minimal and will be outweighed by the benefits of the name change.

The name change will not have any effect on the rights of our existing shareholders. In addition, changing our name will not affect the validity or transferability of stock presently outstanding, and the Compensation CommitteeCompany’s shareholders will not be required to exchange any certificates presently held by them. In the future, new stock certificates will be issued reflecting the new name.

In connection with more direct input from shareholders on our executive compensation policies, practices and procedures. Finally, an annual advisory voteadoption of the “Enerpac Tool Group” business name, our Class A common stock began trading on the compensationNew York Stock Exchange under the ticker symbol “EPAC” on October 7, 2019. The New York Stock Exchange has confirmed that the change in our legal, corporate name to “Enerpac Tool Group Corp.” upon the effectiveness of the proposed amendment to the Restated Articles of Incorporation will not require any further change in our ticker symbol. However, the CUSIP number identifying the shares of our named executive officers is consistent with our objectives of engaging in regular dialogue with our shareholders on corporate governance matters, including our executive compensation philosophy, policies and programs.

For the reasons discussed above, the Board of Directors recommends that shareholders vote in favor of holding an advisory vote on the compensation of our named executive officers once every year. When voting on the frequencyClass A common stock will change as a result of the advisory vote on the compensation ofproposed change in our named executive officers, shareholders should understand that they are not voting “for” or “against” the recommendation of the Board of Directors to hold the advisory vote once every year. Rather, shareholders will have the option to choose whether to approve holding future advisory votes on the compensation of our named executive officers every one, two or three years, or to abstain entirely from voting on the matter.legal, corporate name.

Although the outcome of the advisory vote on the frequency of the advisory vote on the compensation of our named executive officers is non-binding, our Board of Directors will review and consider the outcome of the vote, among other factors, when making future decisions regarding the frequency of advisory votes on executive compensation.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTEVOTING “FOR” APPROVAL OF “1 YEAR” FOR THE FREQUENCY OF FUTURE ADVISORY VOTES TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.NAME CHANGE PROPOSAL.

CERTAIN BENEFICIAL OWNERS

The following table sets forth, as of October 15, 2017,2019, unless otherwise indicated, certain information with respect to the beneficial ownership of common stock by persons known by the Company to beneficially own more than 5% of the outstanding shares of our Class A common stock, by the directors, and nominees for director, by each executive officer of the Company named in the Summary Compensation Table below and by the Company’s current executive officers and directors as a group. Shares are deemed to be beneficially owned by any person or group who has the power to vote or direct the vote or the power to dispose or direct the disposition of such shares, or who has the right to acquire beneficial ownership thereof within 60 days:

|

| | | | | | |

| Beneficial Owner (1) | | Amount and Nature | | | | Percent of Class |

| Five Percent Shareholders: | | | | | | |

Blackrock, Inc. 55 East 52nd Street New York, NY 10022

| | 6,928,942 | | (2) | | 11.6% |

Southeastern Asset Management, Inc. 6410 Poplar Avenue, Suite 900 Memphis, TN 38119 | | 5,900,024 | | (2) | | 9.9% |

Vanguard Group, Inc. 100 Vanguard Boulevard Malvern, Pennsylvania 19355 | | 5,310,943 | | (2) | | 8.9% |

Pzena Investment Management, LLC

320 Park Avenue, 8th Floor

New York, NY 10022 | | 3,917,524 | | (2) | | 6.5% |

Fuller & Thaler Asset Management Inc.

411 Borel Avenue - 300

San Mateo, CA 94402 | | 3,150,941 | | (2) | | 5.3% |

| | | | | | | |

| Named Executive Officers and Director Nominees: | | | | | | |

| Randal W. Baker, President and Chief Executive Officer | | 39,876 | | (3) | | * |

| Gurminder S. Bedi, Director | | 68,122 | | (4) | | * |

| Danny L. Cunningham, Director | | 3,226 | | (5) | | * |

| Rick T. Dillon, Executive Vice President and Chief Financial Officer | | 703 | | (6) | | * |

| E. James Ferland, Director | | 22,758 | | (7) | | * |

| Richard D. Holder, Director | | — | | | | * |

| R. Alan Hunter, Jr., Director | | 79,258 | | (8) | | * |

| Andrew G. Lampereur, Former Executive Vice President and Chief Financial Officer | | 459,643 | | (9) | | * |

| Robert A. Peterson, Chairman of the Board of Directors | | 132,825 | | (10) | | * |

| Stephen J. Rennie, Former Executive Vice President, Industrial Segment | | 108,369 | | (11) | | * |

| Roger A. Roundhouse, Executive Vice President, Engineered Solutions Segment | | 31,905 | | (12) | | * |

| Eugene E. Skogg, Former Executive Vice President, Human Resources | | 116,704 | | (13) | | * |

| Holly A. Van Deursen, Director | | 69,147 | | (14) | | * |

| Dennis K. Williams, Director | | 76,122 | | (15) | | * |

| | | | | | | |

| All Directors and Current Executive Officers as a group (13 persons) | | 652,360 | | (16) | | 1.1% |

|

| | | | | | | |

Beneficial Owner (1) | | Amount and Nature | | | | Percent of Class |

| More Than Five Percent Shareholders: | | | | | | |

Blackrock, Inc. 55 East 52nd Street New York, New York 10055 | | 7,679,988 |

| | (2) | | 12.7% |

Vanguard Group, Inc.

100 Vanguard Boulevard

Malvern, Pennsylvania 19355 | | 6,460,185 |

| | (2) | | 10.7% |

Southeastern Asset Management, Inc. 6410 Poplar Avenue, Suite 900 Memphis, Tennessee 38119 | | 5,900,024 |

| | (2) | | 9.8% |

Wellington Management Company, LLP 208 Congress Street Boston, Massachusetts 02210 | | 5,236,717 |

| | (2) | | 8.7% |

Pzena Investment Management, LLC

320 Park Avenue, 8th Floor

New York, New York 10022 | | 4,345,098 |

| | (2) | | 7.2% |

Clarkson Capital Partners, LLC

91 West Long Lake Road

Bloomfield Hills, Michigan 48304 | | 3,208,074 |

| | (2) | | 5.3% |

| | | | | | | |

| Named Executive Officers and Directors: | | | | | | |

| Alfredo Altavilla, Director | | 3,000 |

| | | | * |

| Judy L. Altmaier, Director | | — |

| | | | * |

| Randal W. Baker, President and Chief Executive Officer | | 150,958 |

| | (3) | | * |

| J. Palmer Clarkson, Director | | 4,719 |

| | | | * |

| Danny L. Cunningham, Director | | 17,528 |

| | (4) | | * |

| Rick T. Dillon, Executive Vice President and Chief Financial Officer | | 21,360 |

| | (5) | | * |

| E. James Ferland, Non-Executive Chairman of the Board of Directors | | 36,204 |

| | (6) | | * |

| Richard D. Holder, Director | | 3,831 |

| | | | * |

| Fabrizio Rasetti, Executive Vice President, General Counsel and Secretary | | 2,848 |

| | | | * |

| Roger A. Roundhouse, Former Executive Vice President, Engineered Components & Systems | | 65,130 |

| | (7) | | |

| John Jeffrey Schmaling, Executive Vice President, Industrial Tools & Services | | 2,263 |

| | | | * |

| Sidney S. Simmons, Director | | 5,014 |

| | (8) | | * |

| Holly A. Van Deursen, Director | | 60,887 |

| | (9) | | * |

| | | | | | | |

| All Directors and Current Executive Officers as a group (13 persons) | | 308,612 |

| | (10) | | * |

| |

(1) | Unless otherwise noted, the specified person has sole voting power and/or dispositive power over the shares shown as beneficially owned. |

| |

(2) | Share ownership,Such information is as of September 30, 2017,2019 and is based on a report issued to the Company by a third partythird-party service provider. |

| |

(3) | Includes 2023 shares held in the 401(k) Plan. Also includes 60,221 shares issuable pursuant to options exercisable currently or within 60 days of October 15, 2019. Excludes 1,0802,268 phantom stock units held in the Employee Deferred Compensation Plan, which are settled in Actuantthe Company’s Class A common stock no less than six months following termination of employment. Mr. Baker does not have any voting or dipositive power with respect to the phantom stock units. |

| |

(4) | Includes 5,000 shares held by a trust. Also includes 51,7492,930 shares issuable pursuant to options exercisable currently or within 60 days of October 15, 2017. |

| |

(5)

| 2019. Includes 3,2268,355 phantom stock units held in the Outside Directors’ Deferred Compensation Plan, which are settled in Actuantthe Company’s Class A common stock, generally within 60 days following the director’s termination of service. |

| |

(6)(5)

| Includes 7031,335 shares held in the 401(k) Plan. Excludes 397804 phantom stock units held in the Employee Deferred Compensation Plan, which are settled in Actuantthe Company’s Class A common stock no less than six months following termination of employment. Mr. Dillon does not have any voting or dispositive power with respect to the phantom stock units. |

| |

(7)(6)

| Includes 8,09911,029 shares issuable pursuant to options exercisable currently or within 60 days of October 15, 2017.2019. Also includes 5,79410,067 phantom stock units held in the Outside Directors’ Deferred Compensation Plan, which are settled in Actuantthe Company’s Class A common stock, generally within 60 days following the director’s termination of service. |

| |

(8)(7)

| Includes 59,749201 shares held in the 401(k) Plan. Also includes 25,282 shares issuable pursuant to options exercisable currently or within 60 days of October 15, 2017. Also includes 7,3732019. Excludes 1,099 phantom stock units held in the Employee Deferred Compensation Plan, which are settled in the Company's Class A common stock no |

less than six months following termination of employment. Mr. Roundhouse does not have any voting or dipositive power with respect to the phantom stock units.

| |

(8) | Includes 5,014 phantom stock units held in the Outside Directors’ Deferred Compensation Plan, which are settled in Actuantthe Company’s Class A common stock, generally within 60 days following the director’s termination of service. |

| |

(9) | Includes 7406,025 shares held in the Employee Stock Purchase Plan and 2,250 shares held by his children through custodians.an individual IRA account. Also, includes 360,38828,959 shares issuable pursuant to options exercisable currently or within 60 days of October 15, 2017. |

| |

(10)

| Includes 16,400 shares held in an individual IRA account and 6,000 shares held in trusts for his children.2019. Also includes 59,749 shares issuable pursuant to options exercisable currently or within 60 days of October 15, 2017. Also includes 33,1406,524 phantom stock units held in the Outside Directors’ Deferred Compensation Plan, which are settled in Actuantthe Company’s Class A common stock, generally within 60 days following the director’s termination of service. |

| |

(11)(10)

| Includes 7596,025 shares held in an individual IRA account and 1,358 shares held in the 401(k) Plan. Also includes 56,009103,139 shares issuable pursuant to options exercisable currently or within 60 days of October 15, 2017. Excludes 1,9542018. Also includes 29,960 phantom stock units held in the Employee Deferred Compensation Plan, which are settled in Actuant common stock no less than six months following termination of employment. Mr. Rennie does not have any voting or dipositive power with respect to the phantom stock units. |

| |

(12)

| Includes 174 shares held in the 401(k) Plan. Also includes 7,331 shares issuable pursuant to options exercisable currently or within 60 days of October 15, 2017. Excludes 591 phantom stock units held in the Employee Deferred Compensation Plan, which are settled in Actuant common stock no less than six months following termination of employment. Mr. Roundhouse does not have any voting or dipositive power with respect to the phantom stock units. |

| |

(13)

| Includes 17,514 shares held in individual IRA accounts. Also includes 39,832 shares issuable pursuant to options exercisable currently or within 60 days of October 15, 2017. Excludes 285 phantom stock units held in the Employee Deferred Compensation Plan, which are settled in Actuant common stock no less than six months following termination of employment. Mr. Skogg does not have any voting or dipositive power with respect to the phantom stock units. |

| |

(14)

| Includes 51,749 shares issuable pursuant to options exercisable currently or within 60 days of October 15, 2017. |

| |

(15)

| Includes 59,749 shares issuable pursuant to options exercisable currently or within 60 days of October 15, 2017. |

| |

(16)

| Includes 16,400 shares held in individual IRA accounts, 6,000 shares held in private trust accounts for children, 5,000 shares held in private trust accounts and 6,4755 shares held in the 401(k) Plan. Also includes 375,366 shares issuable pursuant to options exercisable currently or within 60 days of October 15, 2017. Includes 49,533 shares held in the Outside Directors’ Deferred Compensation Plan, which are settled in Actuantthe Company’s Class A common stock, generally within 60 days following the director’s termination of service. Excludes 18,844 phantom stock units heldShares beneficially owned by Mr. Roundhouse, a former executive officer, are not included in the Employee Deferred Compensation Plan, which are settled in Actuant common stock no less than six months following termination of employment. The executive officers do not have any voting or dipositive power with respect to the phantom stock units.this amount. |

The beneficial ownership information set forth above is based on information furnished by the specified persons or known to the Company and is determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as required for purposes of this Proxy Statement. ItShares are deemed to be beneficially owned by any person or group who has the power to vote or direct the vote or the power to dispose or direct the disposition of such shares, or who has the right to acquire beneficial ownership thereof within 60 days. Such beneficial ownership information is not necessarily to be construed as an admission of beneficial ownership for other purposespurposes.

CORPORATE GOVERNANCE MATTERS

Corporate Governance Guidelines

The Board of Directors (the “Board”) has adopted the Actuant CorporationCompany’s Corporate Governance Guidelines (the “Guidelines”). The Guidelines state that the Board is elected by the shareholders to provide oversight and guidance to management with a view to increasing shareholder value over the long term. The Guidelines cover various topics, including, but not limited to, director independence, board and committee composition, board operations and leadership development. The Nominating & Corporate Governance Committee of the Board monitors and oversees the application of the Guidelines and recommends to the Board any changes to the Guidelines. Each committee has a written charter that is approved by the Board and annually evaluated by the committee.